TINTRODUCTION AND BACKGROUND TO THE BUDGET

Mr. Speaker, Cabinet Colleagues, Members of this Honourable House, Distinguished Guests, Fellow Dominicans at home and abroad, Residents and Friends of Dominica, greetings.

Mr. Speaker we live in extremely challenging and unprecedented times. The world is in a perilous state.

Globally we see protests, conflict and upheaval; wars and rumours of wars are part of the daily news; climate change is wreaking havoc with the natural and built environment; wildfires consume and sweep across large swathes of land; water scarcity and food shortages now abound world-wide.

We are witnessing the health, social and economic consequences resulting from what can be considered a modern plague and pestilence, in the form of the novel Coronavirus, COVID-19.

In the Caribbean, we have seen a volcanic eruption impacting multiple islands, and we have witnessed early in the season, a hurricane making landfall on a sister island, whose last encounter with a hurricane was over six decades ago.

Citizens of every country struggle to come to terms with these wide, sweeping changes, while leaders and governments adapt, and attempt to find solutions where there are no models to guide them.

Yet, in these times of uncertainty and upheaval, we take comfort in the encouragement provided by Psalm 91, “His faithfulness will be your shield and rampart. You will not fear the terror of night, nor the arrow that flies by day, nor the pestilence that stalks in the darkness, nor the plague that destroys at midday.”

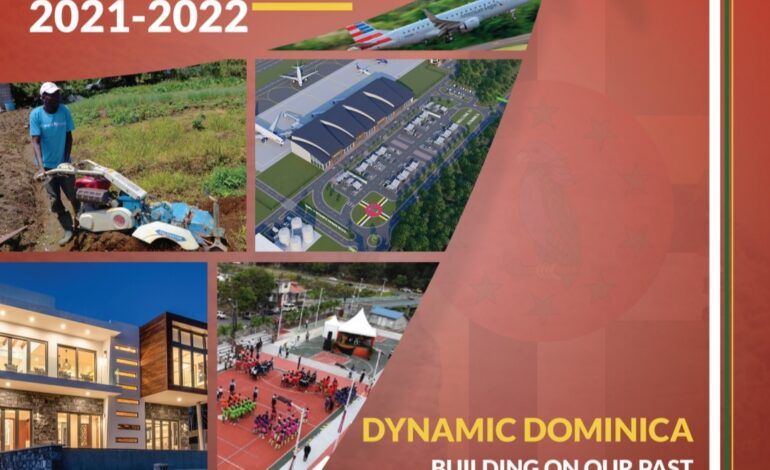

As your Prime Minister, duty and love of country compel me to find solutions, provide resources and foster hope. Hope, which is capable of inspiring a nation and propelling it forward. Your Government, must press firmly and unwaveringly toward the Dynamic Dominica promised by the Dominica Labour Party; the Dynamic Dominica with a strong sustainable economy which our citizens desire and deserve.

1

I present this year’s Budget against the background of the difficulty of these days, but with the unshakeable faith that despite these challenges, there are great opportunities for Dominica. We have demonstrated that we have the skills, resilience and fortitude to navigate successfully these most difficult national challenges, and global circumstances.

Mr. Speaker, I want to begin by tracing our path here, and then look toward the trajectory which this Administration intends for our country. It is a trajectory which will take us to Dynamic Dominica. There may be delays, disappointments and challenges along the path, but as a Government and people, we must not, and we will not be deflected from our objective of Dynamic Dominica.

Almost four years ago, we could have easily descended into extreme poverty, severe economic contraction, and despair. But by God’s amazing grace, and strong and determined leadership, this Administration steered the country on a path that has allowed us to experience and enjoy a remarkable recovery from the devastating storms.

In early 2020 following loss and damage of over 300% of GDP caused by Tropical Storm Erika and Hurricane Maria, the International Monetary Fund (IMF), had forecast strong growth of Dominica’s economy by 5.5, 4.5 and 3.6 per cent, for the years 2020, 2021 and 2022 respectively.

However global circumstances changed rapidly. Little did we know that these difficulties were strengthening us, and preparing us to be able to confront the global health, social and economic crises, brought about by the COVID-19 pandemic.

Mr. Speaker, the COVID-19 virus is the biggest health crisis that the world has had to face in this century, with global recorded infections edging towards 200 million, and the number of deaths exceeding 4 million. With prudent action, and the support and cooperation of our citizens, we have managed to date, to limit infections in Dominica and prevent community spread.

In fact, of the countries for which data is found on the John Hopkins Corona Virus Tracker, as of July 23rd Dominica has had the twelfth lowest number of cases in the world.1

2

We could not have achieved this, without the invaluable commitment and support of our health care and frontline workers, and I wish to once again thank them on behalf of my Government and the people of Dominica.

As of Friday 23rd July, 42% of the adult population are fully vaccinated and an additional 3% are partially vaccinated having had their first dose. I am well aware that there continues to be some degree of vaccine hesitancy among our citizens, but the evidence has proven that getting vaccinated reduces the chances of contracting the virus, severe illness and death. The vaccine is not a cure, but the evidence shows it is an important safeguard. I therefore urge all eligible citizens to get vaccinated as this is the only way that we can effectively beat the virus, resume full and normal social activity, and speedily revive our economy.

Mr. Speaker, I wish to place on the record of this Parliament, Dominica’s deepest appreciation to our partners in the fight against the COVID-19 virus, the Government of the People’s Republic of China, the Government of the Republic of India, as well as the benefactors of the COVAX facility, for making vaccines available to our population.

We also extend gratitude to the Governments of the Republic of Cuba and the Bolivarian Republic of Venezuela, the World Health Organisation (WHO), the Pan American Health Organisation (PAHO), the Caribbean Public Health Agency (CARPHA) and the World Bank (WB) OPEC, CDB, IMF, and all other partners who have been assisting and aiding in our fight against this dreaded virus.

Mr. Speaker, Dominica stands firm today, not by chance, but by the grace of God, our collective efforts, the commitment of our development partners, decisive leadership and careful and strategic planning of your Government.

This Government, which I have had the honour to lead over the past 17 years, has been following a deliberate plan to develop Dynamic Dominica. We have adopted and pursued progressive, transformative policies, investing in our people and their livelihoods, improving our infrastructure, and increasing and expanding services to the public. Dominica is now a prominent, credible voice on climate resilience and sustainability. In every social and economic sector there is clear evidence of Government’s efforts toward transforming Dominica into a modern, resilient, and vibrant country, with a sustainable economy and prosperous people.

3

Mr. Speaker, the reality is that Small Island Developing States, like Dominica, have limited resources and restricted fiscal space. Despite this, and the difficulties posed by global circumstances, this Government’s ability to mobilise resources—particularly from non-traditional sources, and our prudent management of the country’s finances, have resulted in the continued development of this country, and Mr. Speaker, this is without placing any additional tax burdens on the population.

In building resilience, fighting climate change and laying a development path to Dynamic Dominica, this Government has had to be innovative. We are ahead of most, in that we have crafted a comprehensive National Resilience Development Strategy (NRDS), a Climate Resilience Recovery Plan (CRRP), and a Disaster Resilience Strategy, which present a clear framework for us to 2030. These are designed to ensure that we protect lives, livelihoods, and property, and create opportunities for our people.

This framework has helped us in preparing the groundwork for the mobilisation of a significant amount of financing from the Green Climate Fund (GCF) for some transformative projects. Detailed proposals are being finalised for eight priority projects in the areas of agriculture, health, education, development and deployment of renewable energy; housing, and community development.

Preparatory work in respect of some of them have begun and is reflected in the Budget, and we anticipate that within the next 2-3 years, substantial progress on these major projects will be realised.

Mr. Speaker, to achieve Dynamic Dominica, to achieve Resilient Dominica, there are some key matters that must be addressed. No one can deny that air access has been a critical issue, that has held back the pace of our development. We are now on the cusp of revolutionising life and business in Dominica. Construction of our international airport has begun, and this is a major game changer for Dominica. The international airport will be the impetus for the further diversification, transformation and expansion of our economy; and I am honoured to lead this thrust to even more prosperous days for our people and our country.

Mr. Speaker, there is no denying that the global landscape is challenging, that the task at hand is not easy…but the promise I made, the commitment that I continue to make, to substantially improve the lives of the good people of this blessed nation, is what guides my every action. So regardless of the perils of the global landscape, the hurdles, the challenges, the distress and difficulties Mr. Speaker,… it is in this spirit of being

4

progressive and forward thinking, that I compiled this budget for 2021/2022. And so, I present this year’s Budget under the theme:

“Dynamic Dominica – Building On Our Past, Solidifying Our Present, Securing Our Future.”

MAJOR ACHIEVEMENTS OF 2020/2021

Mr. Speaker, the implementation of the Public Sector Investment Programme (PSIP) for fiscal year 2020/2021, was shaped by the need to adjust to the socio-economic impact of the COVID-19 pandemic, while simultaneously building the nation’s resilience to respond to similar shocks in the future, together with continuing our efforts to construct Dynamic Dominica.

Financing constraints and competing spending priorities to save lives and livelihoods, impacted the implementation of domestically financed projects. As a result, priority focus was on ongoing projects, with some considerable effort to facilitate new projects.

I will now provide a sectoral summary of some of our achievements for Fiscal Year 2020/21. Further details on project implementation are contained in the Economic and Social Review publication for fiscal year 2020/2021.

Health

Mr. Speaker, over the last two decades, this Labour Party Government has made substantial investments in health care, recognizing that the health of a nation, is paramount. I can boldly say that we are indeed successfully revolutionizing health care in Dominica for the better.

We have prioritized the development and the upgrade of our health care facilities, the improvement in the delivery of health services, augmented our human resource capacity, improved access, and widened the range of available services.

Under the Smart Health Care Facilities Project, aimed at developing resilient and climate-adapted health care facilities, four facilities are being refurbished. The Grand Bay and Portsmouth SMART Retrofit are both 95 percent complete, and will soon be handed over. Work on the health centers in Trafalgar and Massacre are also ongoing.

5

Twelve new Health and Wellness Centres have been completed. Of these, Mahaut, Portsmouth, Bellevue Chopin, Vieille Case, Wesley and Marigot have been commissioned while the other six—Penville, Anse de Mai, Colihaut, Bagatelle, Soufriere and Newtown, will soon be handed over.

Over the last fiscal year, Phase II and III of the Dominica China Friendship Hospital (DCFH) were completed. These include four new operating theatres; an eight-bed intensive care unit with two isolation rooms; a new Blood Bank; and a modern Ophthalmology unit, with its own operating theatre.

Our investments in the physical structures are complemented by the investments that we have made, in supporting our doctors and nurses in specializing in different disciplines. Many of our doctors have in fact returned to Dominica to serve in the areas of cardiology, nephrology, oncology, and gastroenterology, to name a few.

Mr. Speaker, with the establishment of the Cardiology Unit at the DCFH, we have been able for the first time in the history of this country, to implant a temporary pacemaker in a patient; an achievement we should all be proud of. Mr. Speaker, we intend to continue investments in this area, to ensure that soon we will be able to implant permanent pacemakers, and eventually undertake heart surgeries in Dominica.

It is evident that we are steadily and progressively increasing the number and complexity of medical procedures that are offered at our hospitals. This is in keeping with our strategy, if not to eliminate, but to drastically reduce the need for our citizens to travel overseas for medical emergencies.

Mr. Speaker, as part of our commitment to ensure more efficient and effective healthcare service delivery in Dominica, the Dominica China Friendship Hospital, the Marigot Hospital, and other healthcare facilities, will be brought under the administration of the Dominica Hospital Authority (DHA), recently approved by Parliament. This new governance structure, will come into operation on August 1, 2021.

Tourism

Mr. Speaker, there is general consensus that globally, the tourism industry was the hardest hit by the pandemic. This was inevitable, because of the number of restrictions placed on regional and international travel.

6

This is confirmed by the World Travel and Tourism Council’s (WTTC’s) Economic Impact Report for 2020, which has documented that the pandemic has caused the Caribbean’s GDP to fall from $58.4 billion (14.1%) in 2019, to $24.5 billion (6.4%) in 2020; and the region’s economy to fall by US $33.9 billion, and a loss of some 680,000 travel and tourism jobs.

In Dominica our growing tourism industry was significantly affected and Government moved swiftly to implement a number of measures to cushion the impact on our people and to provide support to them. These included income support to Head of households and single parents for one year, and concessionary loans for up to $15,000 with a one year moratorium on interest and prinicipal payments.

The Novel Corona Virus has changed the world of work, and the ways in which people work. We have therefore developed tourism products that respond to the new realities of the global labour market. In this severely constricted environment, in an attempt to maintain a tourism product, while ensuring the safety of visitors and nationals alike, the Government launched two programmes—Safe in Nature and Work in Nature.

Both programmes focus on allowing visitors to experience the beauty of this country, and are expected to increase visitor arrivals and sustain the livelihoods of the operators in the tourism industry.

The Safe in Nature certification programme, which has become synonymous with Dominica, was launched in October 2020, and has ensured the survival of tourism during the pandemic. To date, 70 properties, equating to 705 rooms, have been certified as Safe in Nature accommodation. Mr. Speaker, in the words of the tour operators, hoteliers, and guesthouse owners, this innovative programme which was initiated by the Government, has provided a lifeline to them, as they were able to continue to receive guests during this challenging period.

The other innovative programme which the Government launched in March 2020, is the Work in Nature Programme, which provides visitors with the opportunity to live and work in Dominica. This programme lends itself to tremendous opportunities for Dominica in the forseeable future, as a new tourism product.

Mr. Speaker, Dominica has been placed on the United Kingdom’s Green List, and categorized as Level 1 by the United States Center for Disease Control; and we have obtained the World Travel and Tourism Council Safe Travels Stamp. They identify our country as a safe destination for tourists, and opens the door for travel by our nationals

7

without being barred from entry into international destinations. This is a clear indication of the effectiveness of the policies implemented by this Government to manage the pandemic.

Agriculture

Mr. Speaker there are flashes of good news, even in the midst of current difficulties. Amid the challenges and restrictions of the COVID-19 lockdown which resulted in the shrinkage of the travel and tourism sector, and reduced domestic activity and spending, the agricultural sector has shown its resilience and continues to expand.

Government has been investing heavily in that sector, recognizing its significant contribution to the growth and development of Dominica. Over the last two years, investments in the agriculture sector and our farmers, amounted to $33.8 million. This includes $27 million under the Dominica Emergency Agricultural Livelihoods and Climate Resilience Project (DEALCRP), to support the restoration of the agriculture sector. As of May 28th, 2021, 3,485 farmers and fisherfolks have benefited from this Project:

- 2,702 farmers received crop input packages consisting of fertilizer, agrochemicals, seeds, and tools of which 2,208 received cash payments to subsidize their labour costs.

- 3,900 bags of feed for pigs and 18,000 chicks were distributed to poultry farmers

- 96 fisher folks received engines consisting of both 50 horsepower and 100 horsepower.

- 605 micro garden farmers received input packages

In addition, Mr. Speaker, the Chinese Agricultural mission in collaboration with the Ministry of Agriculture, has been instrumental in providing seedlings and technical support to our farmers. Between January 2020 to May 2021, over 490,000 high-quality vegetable seedlings, 17,000 flower seedlings and over 2,000 fruit trees seedlings, were propagated and distributed to our farmers.

With government’s support, the agricultural sector continues to provide opportunities and revenue for hundreds of Dominican farmers, including our young people who see this as a viable investment opportunity. What is particularly striking, is that we have seen a dramatic increase in young professionals investing in agriculture. This, Mr. Speaker, is a very encouraging sign.

8

I also take this opportunity to highlight the commitment of the Dominican hucksters and shippers. Under extremely difficult circumstances caused by COVID-19, they have supported the sector, by maintaining weekly shipments to our regional markets of some of our main crops such as Banana, Dasheen, Plantain, Ginger among others, and they should be commended for this.

Mr. Speaker, the Government continues to support new avenues for investment in the agriculture sector. In the last fiscal year we re-established the prawn hatchery. This has allowed farmers to source locally, the larvae to grow full sized prawns, some of which are being supplied to our hotels and restaurants. This is just one of the many examples of the linkages between agriculture and tourism, and the diversification and expansion of our product offerings.

Housing

Mr. Speaker, Government continues to invest heavily in improving the living standards of our people. In fiscal year 2020/2021, an estimated $50 million was spent on construction under the Modern Resilient Housing programme.

Under the Housing Recovery Project, financed with loan funds from the World Bank, the construction of homes has started after some delay. On completion it is expected that 450 homes will be built. Additionally, under the Sustainable Housing Solution Project, 92 families have received homes and an additional 16 homes are currently under construction.

Last year, Mr. Speaker, we introduced two additional measures to facilitate homeowners. We reduced the cost of land registration by 48%, and this measure has been significantly impactful to our citizens. I am pleased to report that the total number of requests for titles during Fiscal Year 2020/21, was 71 percent above the previous fiscal years.

We also provided a grant of $10,000 to first time homeowners 40 years old and under, to encourage people to build their own homes. We can also report that 114 individuals have benefitted from the Homeowners Grant, with a total benefit of XCD 1.1 million.

9

Mr. Speaker, in our Climate Resilience and Recovery Plan, Dominica has targeted, and is working toward having 90% of the housing stock built or retrofitted to resilient building codes. Regional Technical Assistance Centres (TACs) have been established in Portsmouth, the Kalinago Territory, Bellevue Chopin and Mahaut under the direction of the Physical Planning Division, to support citizens and ensure compliance with building codes.

We are pursuing several avenues of support simultaneously, to improve housing in Dominica. We have continued the Home Renovation and Sanitation Programme. Under this programme financial assistance has been provided to homeowners to undertake major renovation works such as roof repairs or replacement, and we have supported the construction of new homes. Assistance has also been provided to construct washroom and toilet facilities and to replace doors and windows.

The housing revolution started by this Government, continues across the length and breadth of Dominica. Hundreds of homes built to withstand earthquakes and hurricanes, have already been constructed. Hundreds of families no longer have to worry about getting wet when it rains, or packing their belongings and heading to shelters when a storm is threatening. They no longer have to live in fear of loss of life or property during the hurricane season. We see people living with dignity, with their heads held high, proud of their climate resilient homes and improved living standards.

I say to our citizens, that I rest better at night knowing that my Government has been able to make a difference in the lives of thousands of citizens, and that in turn these citizens are able to sleep better at night; but we shall not waver in our commitment, until every family is provided with a decent, safe and comfortable home.

The Digital Economy

Mr. Speaker, innovation and the use of ICT is now pivotal to our country’s sustainable development. We accept that the world is changing, and we are committed to leading on the new frontiers which define these changes. Every sphere of activity from education and learning to recreation; from work and business, to socialising, formal and informal communication; from entrepreneurship to market development and penetration, depend on technology. Technological change will lead to the creation of sustainable jobs and to new investments.

10

During the last fiscal year, government secured a loan of EC$ 75 million from the World Bank to fund Dominica’s digital transformation. These funds will facilitate the digitalisation of Government services, as well as the improved access to online services, skills, and technologies among individuals and businesses.

Additional digital initiatives were also pursued including a “Work Online Dominica,” where sixty (60) participants were provided with skills training for accessing online opportunities for income generation. The success of this programme was evident, as fifty (50) out of the sixty (60) participants were successful at securing online jobs. The Programme was facilitated with the support of the UNDP and ISRAID. A second group commenced training in the “Work Online Dominica” Programme in June 2021. We intend to continue to provide these opportunities for our people, particularly the youth.

Mr. Speaker, these are all real, important and tangible steps on the way to Dynamic Dominica.

It is against this backdrop of challenges and hurdles coupled with solid gains and progress, that I now turn to the presentation of Dominica’s macroeconomic performance for fiscal year 2020/2021.

MACROECONOMIC PERFORMANCE

FOR FISCAL YEAR 2020/21

Mr. Speaker, like other countries in the region, Dominica’s economy continues to experience the impacts of COVID-19 as it attempts to rebound from the pandemic.

Based on the revised projections provided by the International Monetary Fund (IMF) in May 2021, economic activity in Dominica contracted by 11 percent in calendar year 2020, owing to reduced activity in all of the main sectors of the economy, including construction, tourism, wholesale and retail trade, and transport.

On the other hand, increased activity in the dominant agriculture sector was again evident in 2020. Mr. Speaker, the agriculture sector registered a second year of positive growth and expanded by 2.1%. Output in the crops sub-sectors increased by 2.3%, while livestock and forestry each grew by 2%, following expansions in the previous year. The

11

strong performance of the agriculture sector is a reflection of the implementation of strategic projects and programmes by this Government, recognizing its importance to livelihoods, maintaining food security and the economy.

The data suggests there was also a 3.5 percent expansion in manufacturing; again, a second consecutive year of expansion, as investments in small and medium enterprises continue to generate economic returns. Financial intermediation, real estate and rents, electricity and water, all recorded positive growth in 2020. (The graph below shows real GDP growth for the period 2013, projected to 2025.)

Figure 1. Real GDP growth for 2013 to 2025 Real GDP Growth 10 5 0 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Real GDP Growth -5 -10 -15

Source: Ministry of Finance preliminary estimates

The Fiscal Position for 2020-21

Mr. Speaker, central government’s fiscal position improved, with an overall deficit of $97.9 million recorded in fiscal year 2020/21, down from $163.2 million in FY 2019/2020. In relation to GDP, the overall deficit moved from 11.1 per cent in fiscal year 2019/20 to 6.9 percent in fiscal year 2020/21. This improved performance was attributable to higher collections of revenue and grants, which more than offset the recorded growth in total expenditure.

Total revenue, inclusive of grants, rose by 37.8 percent to $825.1 million, primarily as a result of higher inflows from non-tax sources. The higher collections of revenue provided the required financing for Government to effectively respond to the COVID-

12

19 pandemic, both in terms of health and livelihood support, and investments in the major productive sectors.

By contrast, tax revenue was lower in fiscal year 2020/21 by $36.2m when compared to the previous year, and by $32.1m when compared to last years’ estimates. The economic impact of the on-going pandemic has continued, resulting in lower than estimated revenues in most main tax categories, except taxes on incomes and profits and property tax.

The chart below compares the components of tax revenue for 2019/20 with the budget and projected outturn for 2020/21.

Figure 2. Components of tax revenue for fiscal year 2019/20 and 2020/21 (EC$ millions)

250.0

200.0

150.0

100.0

50.0

0.0

2019/20

2020/21 Budget

2020/21 Projected Outturn

Taxes on Taxes on Taxes on Taxes on Intl

Incomes & Property Dom.Goods & Trade &

Profits Services Transactions

Source: Ministry of Finance preliminary estimates

Mr. Speaker, total expenditure rose to $923.1million in fiscal year 2020/21, up from $762.1 million in the previous year, driven primarily by higher outlays on public sector investment projects, as Government reduced recurrent expenditure.

The Public Sector Investment Programme (PSIP) remains the main fiscal tool, used to stimulate economic activity. Current data shows an increase in expenditure on the PSIP from $156.4 million in fiscal year 2019/20, to $431.7 million in fiscal year 2020/21. This expenditure was financed by $391.1million from local funds/CBI resources, $25.9million from grants and $8.6million from loans. This outturn exceeds the original budget estimate.

Based on preliminary data, recurrent expenditure was reduced by 18.9% in fiscal year 2020/21. Decreases have been realised in all components of recurrent expenditure, except Personal Emoluments, which showed a slight increase in both salaries and allowances.

13

Mr. Speaker, it is important to note that notwithstanding the decrease in expenditure, there were salary increases; no public officer was sent home and all social programmes continued during fiscal year 2020/21. We were still able to provide support to various groups and productive sectors of the economy.

Mr. Speaker, with the current trends in expenditure, Government is expected to return to a primary balance surplus of 1.2% by fiscal year 2023/24 as the economy continues to expand, thereby shoring up tax revenues.

The table below summarizes the fiscal outturn for 2020/21 with comparative figures for 2019/2020, as well as the budget for 2020/21.

Table 1. Projected outturn for 2020/21 vs. Budget Estimates for 2020/21 and Actual for 2019/20 ($EC Millions)

Budget Estimate Projected Outturn Actual 2019/2020 2020/2021 2020/2021 Total Revenue + Grants 595.0 844.0 825.1 Total Revenue 573.1 695.3 657.6 Recurrent Revenue 571.9 690.3 655.7 Tax Revenue 368.0 359.8 331.8 Non Tax Revenue 204.0 330.5 323.9 Capital Revenue 1.2 5.1 1.9 Grants 21.9 148.7 167.5 Total Expenditure 758.9 968.3 923.1 Recurrent Expenditure 606.6 541.6 491.7 Capital Expenditure and Net Lending 152.3 426.7 431.4 Capital Expenditure 153.2 427.2 431.7 Current Account Balance -34.7 148.7 164.0 Overall Balance -163.9 (124.3) (97.9) Overall Balance % of GDP -11.1 -8.0 -6.9 Primary Balance -126.6 -93.1 -66.4 Primary Balance % of GDP -8.6 -6.0 -4.7 Nominal GDP at Market Prices 1,472.0 1,559.0 1,415.0

Source: Ministry of Finance preliminary estimates

Overview of Public Debt

Mr. Speaker, bearing in mind the need to cushion and adapt to the adverse impact of the COVID-19 pandemic on the economy, and conscious of the thrust to transform the economy, Government contracted additional debt in fiscal year 2020/21. This was to

14

fund our COVID-19 response and recovery programme in health and agriculture, to provide support to individuals and small businesses affected financially by the pandemic; and to assist with financing the Digital Transformation Programme and the rehabilitation of the East Coast Road under the Disaster Vulnerability Reduction Project.

Consequently, as at June 30, 2021, Central Government’s disbursed external debt stood at $771.3 million and domestic debt at $548.5 million; while government guaranteed debt was $148.0 million. The guaranteed debt represented 10.1% of the total debt portfolio, which is below the target of 17% set in the Medium-term Debt Management Strategy.

Mr. Speaker, in May 2020, in an effort to provide liquidity to assist with the fight against the COVID-19 pandemic, the G-20 members and other creditors, offered a one-year debt payment moratorium to countries, through what was referred to as the Debt Service Suspension Initiative (DSSI).

Under this initiative, Dominica received a debt suspension of $17.24 million, or 26.8 percent of the debt service due for the financial year 2020/21. On behalf of all Dominicans, I wish to express sincere appreciation to the Government of the People’s Republic of China (PRC), the Government of the United Kingdom, and the Government of the Republic of France, for the moratorium granted to Dominica.

Mr. Speaker, despite the adverse impact of the COVID-19 pandemic on Government’s fiscal position, we honoured all our debt service obligations in a timely manner throughout fiscal year 2020/21. Central Government’s debt service payments for the period under review was EC$47.1 million. Government also provided support to AID Bank and DOWASCO to meet their debt service obligations.

Moving forward to fiscal year 2021/22, debt service repayment by Central Government is projected at EC$93.9 million, comprising principal of EC$58.3 million and interest of EC$35.6 million. Guaranteed debt repayment for that same period is projected at EC$17.3 million.

There were no breaches of the targets set in the Medium-term Debt Management Strategy, even in these most difficult circumstances. This Government has continued with the prudent management of the country’s finances. We are also committed to achieving the debt to GDP ratio of 60%, and maintaining sustainable debt levels well in

15

advance of the 2035 target agreed to by the Monetary Council of the Eastern Caribbean Currency Union.

Building Financial Resilience

Mr. Speaker, a critical cornerstone of any resilience plan is the ability to sustain one’s self, during and after crises. Extreme weather events will occur and so will pandemics and global economic downturns. We must be prepared to always position ourselves individually and collectively, to be able to respond effectively to such shocks and minimise disruption of normal activity. As the saying goes, we must save for a rainy day, and refrain from overcommitting our finances, in order to meet the extraordinary expenditure which will arise when adverse events occur.

In last year’s Budget address, I indicated that Government had decided to implement a number of measures to build greater resilience to economic shocks. I am pleased therefore to provide an update on Government’s implementation of these measures.

In October 2020, the Vulnerability Risk and Resilience Fund was established to assist with disaster expenditure, and it is held in a special account at the Eastern Caribbean Central Bank (ECCB). An amount of EC$500,000 is deposited in that account every month. The deposits were drawn from CBI revenues. As at today, July 28, 2021, the balance in this account stands at $5 million.

In the event of a disaster, this Fund will give the country some degree of cushion and an immediate pool of funds from which to draw. It is this Government’s intention to increase the monthly contribution when the economy improves. Government shall also mandate every Government owned company and statutory corporation to establish a similar Vulnerability Risk and Resilience Fund.

In December 2020, Cabinet formally approved the Disaster Resilience Strategy (DRS) as an Annex to the Climate Resilience and Recovery Plan (CRRP). The DRS was developed with the assistance from the IMF, and its implementation is being spearheaded by CREAD.

Mr. Speaker, a three-year Medium-Term Debt Management Strategy for the period 2021/22 to 2023/24, will also be laid in Parliament later this year. The anticipation is that this Strategy will guide Government’s borrowings, and assist in achieving the desired debt portfolio, in line with the Strategy. The total public sector debt will be

16

monitored constantly, to ensure that there are no breaches of the targets approved in that Strategy.

We have also increased our insurance coverage with the Caribbean Catastrophe Risk Insurance Facility (CCRIF) by 31.5% for tropical cyclones and 12.5% for earthquakes.

Looking ahead, Government has begun engaging with the World Bank to secure a Catastrophe Differed Drawdown Facility. This facility is yet another source of funds which Government could access in case of an emergency occasioned by a natural disaster or other qualifying event.

All of these actions which I have outlined, will result in Government’s access to a diversified portfolio of mechanisms and instruments, to finance its operations and post-disaster responses, and allow the country to recover much faster.

Mr. Speaker, insurance for the protection of citizens’ lives, livelihoods and properties is of extreme importance. As a result, in May 2021, in partnership with a number of entities, the blockchain parametric product, Flexible Hurricane Protection (FHP) was piloted at the Grand Bay and West Coast Credit Unions.

In the one-month pilot period that this product was available 28 individuals took up policies. The Flexible Hurricane Protection product is being further developed and refined, and a wider national roll out is expected prior to the 2022 hurricane season. We continue to support its development, as an important risk management tool as it is absolutely important that the vulnerable are able to access and purchase insurance coverage.

Economic Outlook

Mr. Speaker, according to the IMF’s World Economic Outlook (WEO) dated April 2021, the global economy is expected to rebound in 2021, following a contraction of roughly 3.3 per cent in 2020. It is projected to grow by 6.0 per cent and 4.4 per cent in 2021 and 2022 respectively. Economic activity in Latin America and the Caribbean is projected to expand by 4.6 per cent and 3.1 per cent respectively, based on the IMF’s publication.

17

The outlook for our economy is also promising. Based on revised projections provided by the IMF in May 2021, Dominica’s economy is projected to grow by 3.4 per cent in 2021, driven in large part by increased activity in the Construction and Agriculture sectors, with a ripple effect evident in other sectors like the Wholesale and Retail Trade and Mining and Quarrying. Developments in the Manufacturing sector are also expected to contribute to the increase in real output.

The projected growth in 2021, led by the planned acceleration in the implementation of the PSIP, will be largely financed by proceeds from the Citizenship By Investment Programme. In FY 2021/22, approximately 58 per cent of the capital budget, equivalent to $253.3m, will be funded by resources from the CBI.

The construction of the International Airport financed by the CBI, is the flagship project in this year’s budget. This highly anticipated project, the largest Government investment in the country’s history, will yield significant economic gains for the duration of its construction and during its operations. Improved air access and the numerous jobs created, will inevitably result in economic prosperity for the country and people alike.

Additionally, a number of ongoing CBI-funded, private sector initiatives are expected to continue in this financial year, among them Tranquillity Beach Resort (Hilton Hotel) at Grand Savanne, Sanctuary Rainforest Eco Resort and Spa at Laudat, Anichi Resort

- Spa (Marriott Hotel) and Secret Bay Residences in Portsmouth, while at least two newly approved projects are expected to commence.

According to the IMF’s May 2021 forecast, Dominica’s economy is expected to grow by 8.1% in calendar year 2022, with growth averaging 5.0 % per annum over the medium term.

It is clear that the CBI programme continues to have a positive, life changing impact on our people and the economy, and indeed justifies its own existence; and that is why Mr. Speaker, it is in the interest of all of us, to protect it, and defend it.

18

Mr. Speaker, the outlook for 2021/22 is expected to show a further improvement in Central Government’s fiscal position, consistent with the projected rebound of the economy.

All of the major components of tax revenue are expected to improve, with taxes on domestic goods and services showing the largest overall improvement. Non-tax revenue reflected mainly by CBI revenues, is expected to play a significant role in stabilising Central Government’s finances. Overall recurrent revenue for 2021/2022 is expected at $853.1 million—an increase of 29.4% over the projected actual revenue for 2020/2021. Table 2 below gives a breakdown of recurrent revenue.

Table 2. Recurrent Revenue for 2021/22 with comparative figures for 2020-21

Estimate Estimates Projected Item 2021/2022 % 2020/2021 % 2020/2021 % Tax Revenue 360.8 42.0% 364.8 52.0% 335.2 51.0% Personal Income Tax 30.9 3.6% 31.6 4.5% 28.8 4.4% Corporate Income Tax 33.7 4.0% 24.5 3.5% 31.3 4.8% Taxes on Property 10.2 1.2% 8.7 1.3% 9.5 1.4% VAT 143.5 16.8% 145.6 20.9% 133.3 20.2% Other Taxes on Goods & Services 66.1 7.8% 66.1 9.5% 61.4 9.3% International Trade Taxes 76.3 8.9% 88.4 12.8% 70.9 10.8% Non-Tax Revenue 492.3 57.7% 330.5 47.1% 323.9 49.1% Total Recurrent Revenuue 853.1 100% 695.3 100% 659.1 100%

Mr. Speaker, this very positive outlook sets the context for the presentation of the Budgetary proposals for the fiscal year 2021/2022.

Recurrent Expenditures

Total recurrent expenditure for the fiscal year 2021/2022, inclusive of those provided by law, is estimated at $650.0 million.

19

Table 3: Recurrent Expenditure by Ministry/Department

Amount % Ministry/Department (000’s m) Office of the President 1.0 0.2% Integrity in Public Office 0.5 0.1% Public and Police Service Commission 0.5 0.1% Legislature 1.2 0.2% Audit Department 1.2 0.2% National Security and Home Affairs 54.7 8.4% Elections 2.7 0.4% Trade, Commerce, Entrepreneurship, Innovation, Business and Export Development 2.1 0.3% Office of the Prime Minister 12.6 1.9% Finance 266.1 40.9% Blue and Green Economy, Agriculture and National Food Security 8.6 1.3% Education, Human Resource Planning, Vocational Training and National Excellence 77.0 11.8% Housing and Urban Development 3.9 0.6% Health, Wellness and New Health Investment 59.9 9.2% Environment, Rural Modernization and Kalinago Upliftment 9.3 1.4% Tourism, International Transport and Maritime Initiatives 18.1 2.8% Sports, Culture & Community Development 13.5 2.1% Economic Affairs, Planning, Resilience and Sustainable Development, Telecoms and Broadcasting 4.6 0.7% Establishment 8.2 1.3% Public Works and the Digital Economy 58.9 9.1% Foreign Affairs, International Business and Diaspora Relations 19.9 3.1% Cabinet Office 3.7 0.6% Youth Development and Empowerment, Youth at Risk, Gender Affairs, Seniors Security and Dominicans with Disabilities 19.4 3.0% Governance, Public Service Reform, Citizen Empowerment, Social Justice and Ecclesiastical Affairs 2.4 0.4% GRAND TOTAL 650.0 100.0%

Mr. Speaker, the Ministry of Finance has the largest allocation of the recurrent expenditure to the tune of $266.1 million or 40.9% of the total. Of this amount, $94.8 million is for debt service payment; $41.5 million is appropriated for retirement benefits, which includes payment of gratuities, pensions, compassionate allowances, contractual gratuities and non-contributory pensions; and $12.5 million has been allocated for the one-off salary payment to public officers for the fiscal year 2018/2019, following negotiations with the unions.

20

The Ministry of Education, Human Resource Planning, Vocational Training and National Excellence, will receive the second highest allocation of 11.8% or $77 million. Mr. Speaker, this Government will continue to invest in the development of our young people, consistent with this Labour Party Administration’s philosophy of using education to transform the country, advance our people, elevate our youth and impact the world.

The third largest budgetary allocation in the sum of $59.9 million or 9.2%, is to the Ministry of Health, Wellness and New Health Investment.

The Ministry of Public Works and the Digital Economy is allocated of $58.9 million, or 9.1% of the total Budget.

An amount of $54.7 million, or 8.4% of the total Budget is allocated to the Ministry of National Security and Home Affairs.

The Ministry of Tourism, International Transport and Maritime Initiatives and the Ministry of Youth Development and Empowerment, Youth at Risk, Gender Affairs, Seniors Security and Dominicans with Disabilities, have been allocated $18.1 million, and $19.4 million respectively.

Mr. Speaker, this government has consistently placed particular emphasis on two very important demographics of our society: the youth and our senior citizens. In that regard, we have injected additional funds into the Youth Skills Training Programme and we continue to maintain our Yes we Care programme, our 70 and over non-contributory pension and other support to our seniors.

21

Mr. Speaker, Table 4 below, provides a summary of recurrent expenditure by economic classification.

Table 4: Recurrent Expenditure by Economic Classification ($M)

Classification Estimate % Estimates % Projections % 2021/2022 2020/2021 2020/2021 Personal Emoluments 187.2 29% 168.2 28% 164.5 30% Goods & Services 249.2 38% 238.3 39% 190 35% Interest 35.0 5% 31.2 5% 31.5 6% Transfers and Subsidies 113.0 17% 36.5 6% 106 20% Refunds 5.0 0.1% 66.8 11% 3.6 1% Investment Financing 0.5 0.1% 0.5 0.1% 0.3 0% Sub-Total 589.9 90% 546.6 89% 496 92% Debt Amortization & Sinking Fund 60.1 9.2% 59.9 9.9% 45.4 8% Total 650.0 100% 606.5 100% 541.5 100%

Public Sector Investment Programme 2021-2022

Mr. Speaker, the social and economic disruptions caused by COVID-19 have created a greater urgency to rationalise public sector investments, and make them more responsive to the changing global environment. Government will therefore continue to invest in a number of high growth sectors such as agriculture; manufacturing; construction and tourism; the international airport, expanding the use of renewable energy; encouraging a culture of entrepreneurship; promoting Dominica as a green and safe tourism destination; and creating a special financing facility at the AID Bank for small and medium size enterprises.

The intention of Government by making these investments is to foster diversification and the resilience of the economy. They are also intended to promote an entrepreneurial class and to boost local business and domestic enterprises.

These investments will define the new economy of Dynamic Dominica and help to create a modern world class society in which our citizens, our youth, and our seniors can have their dreams fulfilled here at home without having to migrate for greater opportunity and a better life.

22

Mr. Speaker, the Public Sector Investment Programme for Fiscal Year 2021/2022 is estimated at $438.9 million and financed as follows:

o Local funds: $253.3 million (57.7 percent) o Loan: $64.8 million (14.8 percent) o Grant: $120.8 million (27.5 percent)

Table 5: Specific Line Ministry Allocations (PSIP)

Ministry Total Share of Million($) Budget Office of the President 1.1 0.24.% National Security and Home Affairs 31.1 7.07% Electoral Commission 0.3 0.07% Trade, Commerce, Entrepreneurship, Innovation, Business and Export 4.4 1.00% Development Office of the Prime Minister 87.0 19.82% Finance 33.0 7.52% Blue and Green Economy, Agriculture and National Food Security 31.9 7.28% Education, Human Resource Planning, Vocational Training and National Excellence 13.6 3.10% Housing and Urban Development 57.1 13.01% Health, Wellness and New Health Investment 32.0 7.29% Environment, Rural Modernization and Kalinago Upliftment 41.9 9.54% Tourism, International Transport and Maritime Initiatives 6.0 1.36% Sports, Culture & Community Development 7.3 1.67% Economic Affairs, Planning, Resilience and Sustainable Development , 8.4 1.92% Telecommunications and Broadcasting Establishment, Personnel and Training 0.8 0.19% Public Works and the Digital Economy 74.3 16.94% Cabinet Office 4.3 0.97% Youth Development and Empowerment, Youth at Risk, Gender 3.8 0.85% Affairs, Seniors Security and Dominicans with Disabilities Governance, Public Service Reform, Citizen Empowerment, Social 0.6 0.15% Justice and Ecclesiastical Affairs GRAND TOTAL 438.9 100%

23

MAJOR STRATEGIC INITIATIVES IN 2021/22 TO ACCELERATE GROWTH AND SUSTAINABLE DEVELOPMENT

Digitialisation of our Economy

Mr. Speaker, in today’s interconnected world, digitialisation and technology are the bridge to our future. A modern, resilient and sustainable, dynamic economy must be supported by technology. Over the medium term, investments will be focused on creating a modern ICT system with island-wide coverage, that allows for the integration of ICT in education, business development, transportation and homes, that can facilitate remote work, remote learning and access for citizens to engage in a range of activities.

Mr. Speaker some important programmes planned for this fiscal year include;

- The procurement of 8000 tablets for primary school students;

- The conduct of a feasibility study for a new National Health Management Information System. This system will provide efficient and effective service in the health sector, as well as evidence-based information for decision making and;

- The establishment of a Computer Emergency Response Team (CERT) in order to ensure that the information systems are safe against any cyber threat or attack.

Importantly laws and policies that cover e-transactions and digital signatures, will be reviewed and updated to ensure that online transactions are protected by law. The project will also make provision for digital skills development by building the capacity of Micro Small and Medium size Enterprises throughout the island. It is anticipated that when trained, entrepreneurs will be able to effectively promote, market and sell their products and services on various digital platforms. Which will no doubt generate business and foreign exchange.

During the month of September 2021, the Eastern Caribbean Central Bank in collaboration with this Government, will introduce in Dominica the digital EC currency, “DCash”. The introduction of DCash will facilitate the reduction in physical cash transactions and foster economic growth, resilience and the competitiveness of Dominica. Local businesses such as restaurants, bars, taxis, for example, will be able to accept payments with their smart phones.

We are aware that some individuals are not in possession of bank cards, while many small businesses are of the view that point of sale systems are too expensive. These EC payments and transfers can be effected in person by simply scanning a code on the receiver’s smart device and/or remotely by having the payer enter the receiver’s unique

24

ID, inserting the amount to be paid, and clicking ‘Send’. DCash is legal and secure and offers a safer, faster and cheaper way to conduct business. More information will be provided to the public during the coming months.

Geothermal Development

Mr. Speaker, an economy that is powered by renewables, resulting in reduced energy costs and carbon emissions, while simultaneously creating jobs, is one of the cornerstones of the economy of Dynamic Dominica.

Work on the Geothermal Development Project in the Roseau Valley has accelerated over the past year. Construction of two additional wells in Laudat has started. With the financial and technical support of the World Bank, we recently conducted five (5) procurements, valued at over US $13 million (XCD35.1 million), associated with the drilling of these wells. This includes the civil works for access roads and well pads, for which a contract of $ 9 million was awarded to ACE Engineering Ltd., in May 2021.

We are also at an advanced stage for the selection of an Engineering Procurement and Construction (EPC) contractor, to build the 10 MW plant. We expect to conclude negotiations by the end of September, and soon thereafter to issue a notice to proceed with construction of the power plant. Construction time is expected to be 18 months from issuing the notice to proceed.

The transfer of power from the geothermal power plant in Laudat to the main load centres in Fond Cole and Sugar Loaf, will require higher voltage transmission lines. We are working closely with DOMLEC and the Independent Regulatory Commission to develop this new network. The new transmission lines will also contribute to a more resilient electricity network, by providing redundancy for transmitting power, from the existing hydro stations in the Roseau Valley.

The progress which we are making on this project would not be possible without the support and cooperation of the people of the Roseau Valley, as well as the World Bank and many friendly governments, and we are very appreciative of this.

25

Mr. Speaker, this Government is making major investments to facilitate the transformation of the tourism sector. We are approaching tourism development from all angles.

Dominica has been singled out by the Cruise lines as one of the countries in the Caribbean with the best quality road network. This signifies the tremendous efforts by this Government to upgrade roads throughout the country. And this year, we will begin the reconstruction of the Layou Valley Road and accelerate work on the East Coast Road—both are arteries to major tourism sites.

One of the aims of this Government is to increase opportunities for visitors to spend more in Dominica. We are pursuing several avenues to fulfil this objective. One of these is the Roseau Enhancement Project. We are transforming Roseau into a modern attractive shopping, hospitality, and entertainment centre, with amenities which will allow visitors to enjoy day and night life, thereby creating business opportunities for our people.

Mr. Speaker, we have also pursued the upgrading of our sites and attractions to make them more appealing and accessible to our visitors. In this financial year, we will see substantial improvements to some of our most visited sites and attractions, in areas such as Champagne Beach, Scotts Head, Indian River, Trafalgar Falls, Emerald Pool, Wotten Waven and others.

In addition, a complete audit and redesign of the Waitukubuli National Trail will be undertaken, to allow for its full rehabilitation and reconstruction.

Our trails and sites are the basis for the unique appeal of Dominica. As such, it is important to continue to take bold steps towards management, preservation, sustainability, marketing and monetizing of these assets. We recognize that government’s investments in these tourism assets will be more meaningful with the participation of all key stakeholders.

Government will establish an Authority to oversee all aspects of trails and sites in Dominica. The authority will coordinate their development, maintenance, financial management, and conservation under one legal authority.

26

Mr. Speaker, our increased use of technology in the economy will improve the countries ratings among visitors, particularly those from developed country who are accustomed to technology as a way of life.

Dominica can now boast of having three 5-star hotels and another three are under construction. These investments will substantially increase the number of export-ready rooms available on island and be an impetus for attracting more visitors, and more business to our shores. They also encourage a vibrant staycation culture. By 2023, an additional 498 rooms will become available. This is a massive achievement in a short space of time for a small country like Dominica.

The tremendous investments towards increasing productivity of the agricultural sector will reinforce the backward and forward linkages between these two growth sectors. Farmers and fisherfolk can rely on the tourism sector for a constant and secure market and hoteliers can assure guests that their food is grown locally. We are currently propagating and producing a number of crops, livestock and sea foods to supply the major hotels. As we expand the agricultural sector, there is no doubt that we will be able to fully supply all of the hotels with fresh products. Agro-tourism is also an evolving pillar under the overall thrust of the industry.

We are making significant investments in the development of geothermal energy not only as a clean source of energy that enhances our appeal as the Nature Isle, but it offers more affordable energy and therefore will lower operation costs for our hotels and guesthouses.

We have been working on air access. This continues to bear fruit with Caribbean Airlines now offering direct flights from Barbados and Trinidad and American Airlines’ recent announcement of a direct flight from Miami.

Mr. Speaker, our unique product offering is sought after by travellers from all over the world. Government’s investment in the construction of an International Airport will bring the world within closer reach to all that Dominica has to offer and will have significant positive benefits for all of our tourism stakeholders.

27

Investing in Agriculture Farmers and Fishers

Mr. Speaker, agriculture remains a top priority for this Government. Budgetary allocation of $31.9 million has been provided during this fiscal year for initiatives which will advance the continued expansion of the agriculture sector.

The development of banana and plantain, vegetable and livestock will continue; as well as the modernization of the processing of traditional crops such as cassava, touloma, bayleaf, herbs and spices; and tree crop expansion, will also take place.

The agriculture resilience programme will also continue with the distribution of seedlings, fertilizers and inputs to farmers. In this financial year we will begin the implementation of the livestock and infrastructure components of the DEALCRP project. Motorized tools and equipment to the tune of $5.0 million, will be distributed to farmers.

In addition, 250 livestock farmers will receive assistance in the form of materials valued at $3.1 million, to facilitate construction of climate resilient animal housing. Also, over 50 fisherfolks will receive newly constructed fishing boats.

Renovation works will continue at the Central Livestock farm at Londonderry at a cost of $1.2 million. The 5 Regional Offices in—the North East, East, Central, South and South East will be refurbished to support the Division of Agriculture in the delivery of essential services to our farmers. We will also rehabilitate 3 propagation centers in Londonderry, Woodfordhill and LaPlaine to facilitate the availability of planting material for restoration of tree crops, root crops and perennials.

The construction of the Agriculture Science Complex Building at One Mile was delayed due to COVID-19 restrictions, however this project to be undertaken by the Government with the valuable support of the Government of the People’s Republic of China, will commence in January, 2022. This important Complex will house a training centre, tissue culture lab and accommodation for the experts.

Mr. Speaker, this fiscal year we will see the total rehabilitation of the Roseau Fisheries complex and restoration works at the Marigot Fisheries Facility post hurricane Maria damage, with grant financing from the Government of Japan. This project was similarly delayed by COVID. On May 24, 2021, however we signed a contract with a Japanese Firm to undertake these two projects. Work is scheduled to commence on July 31, 2021. This will enhance the quality and safety of the handling of fish products for consumers.

28

This project is valued at approximately $27.0 million dollars, $10.7 million of that amount is expected to be spent during this fiscal year. We thank the Government of Japan for partnering with the Government of Dominica on this important project.

Mr. Speaker, over the years, we have achieved a reasonable level of success in agricultural production. However, with the advent of the international airport and in our quest to expand and modernize the agricultural sector, there is a need to rationalize all existing agriculture systems/services being provided by the government. To this end, we have decided to establish an Agricultural Development Authority, with a focused mandate of linking production to market, through research and development.

There have been concerns expressed about the need to have better coordination between the factors of production and marketing. The Government is of the view that it is in the interest of our farmers to create a single entity to coordinate all aspects of production and marketing. In that regard we are proceeding with the establishment of an Authority that will focus on linking products to markets. We anticipate that this mandate will be carried out with a mix of the following:

- Marketing and Market Access for specified crops,

- Production,

- Technology introduction and adaptation, and

- Financing to support the commercialization of agricultural production and agri-business.

- Plant propagation

- Research and development

We intend to consult with stakeholders on this process. It is expected that the governance structure of such an Authority will be under the direction of the Minister of Agriculture, and will be comprised of both public and private sector interests.

Development of the Cannabis Industry

Mr. Speaker, further to the decisions taken by the Government in respect to cannabis in last years’ Budget, Government is now ready to explore all the possibilities that investments in cannabis offers, particularly the value-added component of cannabis, such as the production of marijuana oils, supplements, and other products that the global market demands.

29

The point is Mr. Speaker, many of our citizens who have been suffering from cancer have proclaimed that the marijuana oil is a very important part of their treatment, and we do not think that our people who are suffering and need this to cushion their pain, should have to procure these oils in a clandestine manner. We will therefore put in place the necessary structure to allow for the production and procurement of these oils transparently and legally.

On a broader scale, bold and decisive action on Dominica’s involvement in the cannabis industry is needed. In that regard a National Task Force has been established to give focused attention to this important area, which can pave the way for multiple new jobs, and be an important revenue earner.

Upgrading Road Infrastructure

Mr. Speaker, there can be no argument in this country that this Government has spent substantial sums of money in improving roads in Dominica. This includes our primary, secondary and even village roads. The significant improvements that we have made have been affected by disasters, but this has not caused us to waver, because we have always held the belief that in order to enhance commerce, tourism and trade, the country must have good road infrastructure. With this in mind $63.8 million of the Budget has been allocated to the enhancement of our road infrastructure.

East Coast Road Rehabilitation

Work on the $126 million East Coast Road project will continue during this fiscal year. This project includes the road realignment and resurfacing, new drainage systems and the construction of several bridges. This Project is progressing satisfactorily. Seventy-nine individuals are currently employed on this Project, and we expect this number to increase as work continues.

Restoration of Layou Valley Road

Mr. Speaker, earlier this month Government signed a contract valued at $11.6 million for the construction of the first section of the Layou Valley Road, that is, from Hillsborough Bridge to York Valley Bridge. Consistent with our resilience policy, this Project will include a full realignment of that section of road away from the river. It will comprise retaining walls, where required, for additional protection to mitigate against flood risks. Work will commence by August 2021.

30

Designs for the second section of the Layou Valley Road, from York Valley Bridge to Sultan have been completed, and are being reviewed. Work on this is expected to begin before the completion of the first section, and no later than Fiscal Year 2022/2023. The full restoration of this major road artery will greatly facilitate the farmers in the Layou area, service providers in the tourism industry, and residents of the West, North and East coasts of Dominica.

Hillsborough East Bridge

To complement the Layou Valley Road Project, work will continue on the restoration of the Hillsborough East Bridge, which was damaged during the passage of Hurricane Maria. The cost of this project is $8.9 million.

Roseau Enhancement

Mr. Speaker, Roseau our capital city, is the commercial heartbeat of this country, therefore whatever happens in the City, impacts the entire country. The vision of this Dominica Labour Party administration is to transform Roseau into a modern, green, dynamic, resilient city.

As you can see Mr. Speaker, the transformation has already begun. We have brought excitement to Roseau, particularly, with the development of the new River Bank promenade and the commissioning of the Windsor Park Forecourt multipurpose hardcourts facility. All of these have facilitated the creation and expansion of businesses, increased activity, and have brought new life to the City.

Let us not forget that all of this began with significant investments in roads and bridges, which has relieved traffic congestion to and through the City. To date, this Government has constructed three new bridges—the West Bridge, the Dominica China Friendship Bridge and the Goodwill link road Bridge. We also reinstated and upgraded the EC Loblack Bridge.

This Government also constructed the Roseau to Goodwill link road and the stadium by-pass, as well as river defence walls along the greater part of the river bank.

31

Mr. Speaker, the Roseau Enhancement Project will continue this year with the reconstruction and enhancement of the Great George Street and Independence Street. This will include an improved drainage system, new road surface, pedestrian friendly sidewalks which importantly will cater to people with disabilities, covered drains, enhanced lighting, and the placement of utility lines underground.

Immediately thereafter we will begin similar activities on King George V Street.

There is no doubt that these investments will increase the value of properties in Roseau. We have seen the construction of a number of new buildings in the City over the past ten years. We hope to see this trend continue with the replacement of current abandoned properties with brand new structures. I therefore urge businesses and private residents to join in and upgrade their properties.

Meanwhile Mr. Speaker, the River Bank Resilient Housing apartments are nearing completion and will provide shelter to 66 families and commercial spaces for 8 business owners. Additional apartments will be constructed on River Street and in Pound as the Government believes that we need to maintain our City’s unique feature of being a residential city.

During this financial year we will also construct a new ferry terminal on the Dame Eugenia Charles Boulevard, which will include shopping, entertainment and hospitality facilities, geared towards increasing visitor spend and bringing additional income to our people. In addition, we will build a commercial building which will accommodate a movie theatre built for purpose and a mini mall, in an effort to enhance attractions not only for our citizens but visitors as well. It is not the Governments intention to manage these facilities, but to avail them to Dominicans to do business.

The old market will also be transformed into a safe in nature mini cruise village while at the same time maintaining its historical value, significance and stature. The transformation of the Old Market will enhance the business opportunities for the existing vendors, in addition to opportunities for new entrants.

Mr. Speaker, the future is bright for the city and the people of Roseau, as we continue to transform and enhance the City.

32

Mr. Speaker, Government is making every effort to commence the rehabilitation of the Loubiere to Bagatelle Road during this fiscal year. This road is to be financed by a grant from the Government of the United Kingdom. A first set of designs was completed in calendar year 2020. However, the cost of rehabilitation based on these designs far exceeded the grant and the road had to be redesigned and broken up into phases. The geotechnical investigations are ongoing that project from Loubiere to Grand Bay and the advertisements for prequalification of contractors have been published.

We are aware of the major vulnerability along this road. We are very concerned that it has not yet started. Notwithstanding our best efforts to accelerate this Project, we have encountered several challenges many beyond the control of this Government. We thank the residents of the south for their patience and support as we look forward to the commencement of this Project no later than the fourth quarter of this fiscal year.

The International Airport

Mr. Speaker, the most impactful Public Sector Investment Project to be undertaken in the history of this country is the international airport. This priority project has already begun with spending programmed for this year at $75 million.

On June 9, 2021, this Government set into motion the fulfillment of a promise made to the people of this beloved country by the Dominica Labour Party.

Government has acquired all of the lands required for the airport, and impacted residents are being relocated. The lab for materials testing for the airport is now 70% complete. Mr. Speaker, 30 homes are currently under construction at Joe/Burton for those who opted for homes instead of cash payments. These homes will be built to our established resilient standards.

Joe/Burton, is buzzing with activity as we speak, 6 contractors are on site and over 100 people are employed. We expect these homes to be completed by the end of September, this year.

33

This new housing development has a total of 140 residential lots, situated on 34 acres, which provides a great opportunity for other potential homeowners to own a piece of Wesley. The additional lots will soon be available for sale as part of our strategy for community expansion.

Mr. Speaker, the international airport will facilitate the physical and economic transformation of this country in a manner never seen. It will catalyse sustainable growth and development, engendering tremendous economic gains, through its direct impact; starting in the Wesley/Woodford Hill area, then spreading to all parts of Dominica and touching Dominicans at home and abroad.

The presence of an international airport will position Dominica to expand our exports. Farmers will be able to export more produce and receive higher margins, and there will be greater opportunities for value added agricultural products. It will be the lever for cottage industries exporters and manufacturers to the Dominican diaspora and to regional and international markets.

That is why Mr. Speaker, this visionary Government has set aside 150 acres of land to be used for agriculture. Wesley/Woodfordhill/Palm Tree is known as one of the major bread baskets of Dominica, and we are ensuring that agriculture production not only continues but will be expanded to respond to the opportunities created as a result of the International Airport.

Dominica’s international airport will be one of the most attractive airports in the region. There will be 4 jet bridges, state of the art baggage sorting and scanning systems, faster immigration processing and the use of technologies to ensure passengers receive a world class experience. This will include self-check-in kiosks, VIP and Airport Executive Lounges to facilitate an increase in the number of business visitors and tourists to our country.

Mr. Speaker, people all over the world are keen to visit our country. Dominica with its abundance of natural attractions, its friendly people, safety, stable Government, healthy place to live, and its recently constructed 5-star hotels, has become one of the most sought-after destinations. The problem has been, access to this beautiful country.

This is why, we in this Government will not rest until we build the international airport. Getting to Dominica can be very costly. It is also a grave inconvenience given the

34

number of stops to get here. Some have had to overnight, some have had to spend long transit times just trying to connect, not forgetting the limited flight options.

Our international airport will fix this! People want to come to Dominica! Dominicans in the Diaspora want to come to Dominica! Dominicans want weekend trips. And by the Grace of God, this Labour Party government, will build the international airport!

We have embarked on a marketing campaign internationally, not only promoting Dominica but also letting the world know that in just a few years Dominica will have a state of the art, modern international airport capable of accommodating long haul aircrafts from major capitals in Europe, North America and the rest of the world.

Every Dominican will be proud of this international airport, including those who do not support the Government. It will help secure all of the investments that we have made, and are making in tourism, in agriculture and in improving the environment for doing business in Dominica.

And I want to say to the citizens of this country Mr. Speaker, that this international airport is being built solely with funds from the CBI, and will place absolutely no tax or debt burden on them, or generations to come.

On behalf of the Government and all Dominicans, I extend our thanks to the people of Wesley, Woodford Hill and Palm Tree, for their continued cooperation and support, and for their contribution to national development. We also express our gratitude to Montreal Management Consultants (MMCE) for partnership with the Government and people of Dominica to develop this dream project. I also take this opportunity to thank the many public officers who are working tirelessly to ensure that this project is a success.

Mr. Speaker the latest announcement by American Airlines in the last few days that they will now commence direct flights from Miami to Dominica, has been met with great joy and excitement. This is a major achievement, particularly during the COVID-19 pandemic, at a time when airlines are cutting back on flights, this is a vote of confidence in our destination by American Airlines. This is a result of the hard work that your Government has been doing to market and prepare this country, and the significant investments that we have made in improving our infrastructure and our hotel offerings. The direct flights from Miami to Dominica will begin on December 8, 2021.

35

Members of this Honorable House, this is just the beginning. The future is bright for Dominica, the future is extremely bright for the children of Dominica.

Mr. Speaker, I have presented the principal features of the Capital Estimates for the fiscal year 2021/2022, including a portfolio of planned capital investments in the main productive sectors which will facilitate the transformation of Dominica. We are creating Dynamic Dominica, a prosperous, resilient, peaceful, secure and just society; a stable, sustainable economy; and a protected environment. My Government will continue to work toward this goal.

FOCUSING ON THE LIVES AND LIVELIHOODS

OF ALL DOMINICANS

Improving Public Health Services

Mr. Speaker, an improved standard of health care remains one of this Government’s top priorities. Focus will continue on improving access to, and the delivery of quality public health services, with a total allocation of $32.0 million in the PSIP.

Work on the final Phase of the Dominica-China Friendship Hospital (DCFH) is ongoing. When completed, the DCFH will offer a wider range of medical services delivering improved standards, under the new Dominica Hospitals Authority (the Authority) which is expected to commence operations on August 1, 2021.

Mr. Speaker, we expect that with this new Authority, there will be greater accountability and efficiency, which will result in better patient care.

The new Marigot Hospital, in which we have invested approximately $50.0 million, is 98% complete and will be commissioned this year. This new hospital will comprise 38 beds, an ICU, two isolation rooms, a two-room operating theatre and a four-bed recovery room. These are among many of the features which will allow for a significant expansion in the services that will be offered to the people of the Marigot Health District.

36

Primary Health care has no doubt received a significant boost with the completion of our 12 new Health and Wellness Centre which will enhance the delivery of services to citizens and residents. This financial year we will witness the construction of three additional health and wellness centres in the city of Roseau, St. Joseph and Savanne Paille.

Improving Housing

Mr. Speaker, this Labour Party led Government will continue its commitment to improve the living and housing standards of our people and with this, $57 million has been allocated to the Ministry of Housing.

During this fiscal year, Government intends to build a total of 785 new homes for our people. In addition, we will also invest in the home renovation and sanitation programme. Funds for the construction of those homes will come from a loan contracted from the World Bank, grant funds from the European Union and the Citizenship by Investment Programme.

The Housing Recovery Project which will benefit 450 recipients of new homes, will be allotted $6m.The Home Renovation and Sanitation project will also continue into the fiscal year, at a cost of $4m; while under the Modern Resilient Housing Project, 235 new homes are expected to be completed within the next 12 months.

Another avenue employed to address the housing need has been the Sustainable Housing Solutions option. This modality utilizes a precast concrete system to construct homes. To date, quite a few families have benefitted. Considering our ambitious efforts to provide housing to our vulnerable people, this option reduces the time for construction of units. I have been advised that the precast plant here in Dominica is now complete and will substantially increasing the speed at which homes can be built. A minimum of 50 homes will be targeted for this fiscal year, at an estimated cost of $2 million dollars.

37

Investing In Our Kalinago People

Mr. Speaker, the economic and social advancement of our indigenous people continues to be a priority for my Government. Over the years, we have implemented a number of initiatives aimed at improving living standards of the Kalinago people in the areas of housing, employment, health, education and small business to name a few. In this fiscal year, this work will continue.

We know that our Kalinago people have had severe housing challenges posed by communal land ownership. This Government proposes to continue to provide support to the Kalinago through a number of avenues. We have directed funding from the European Union to the Kalinago Territory, to construct 50 resilient homes