EU Finance Ministers have updated the EU list of non-cooperative tax jurisdictions, based on an intense process of analysis and dialogue steered by the Commission. The list has proven a true success with many countries having changed their laws and tax systems to comply with international standards.

Over the course of last year, the Commission assessed 92 countries based on three criteria: tax transparency, good governance and real economic activity, as well as one indicator, the existence of a zero corporate tax rate. Today’s update shows that this clear, transparent and credible process delivered a real change: 60 countries took action on the Commission’s concerns and over 100 harmful regimes were eliminated. The list has also had a positive influence on internationally agreed tax good governance standards.

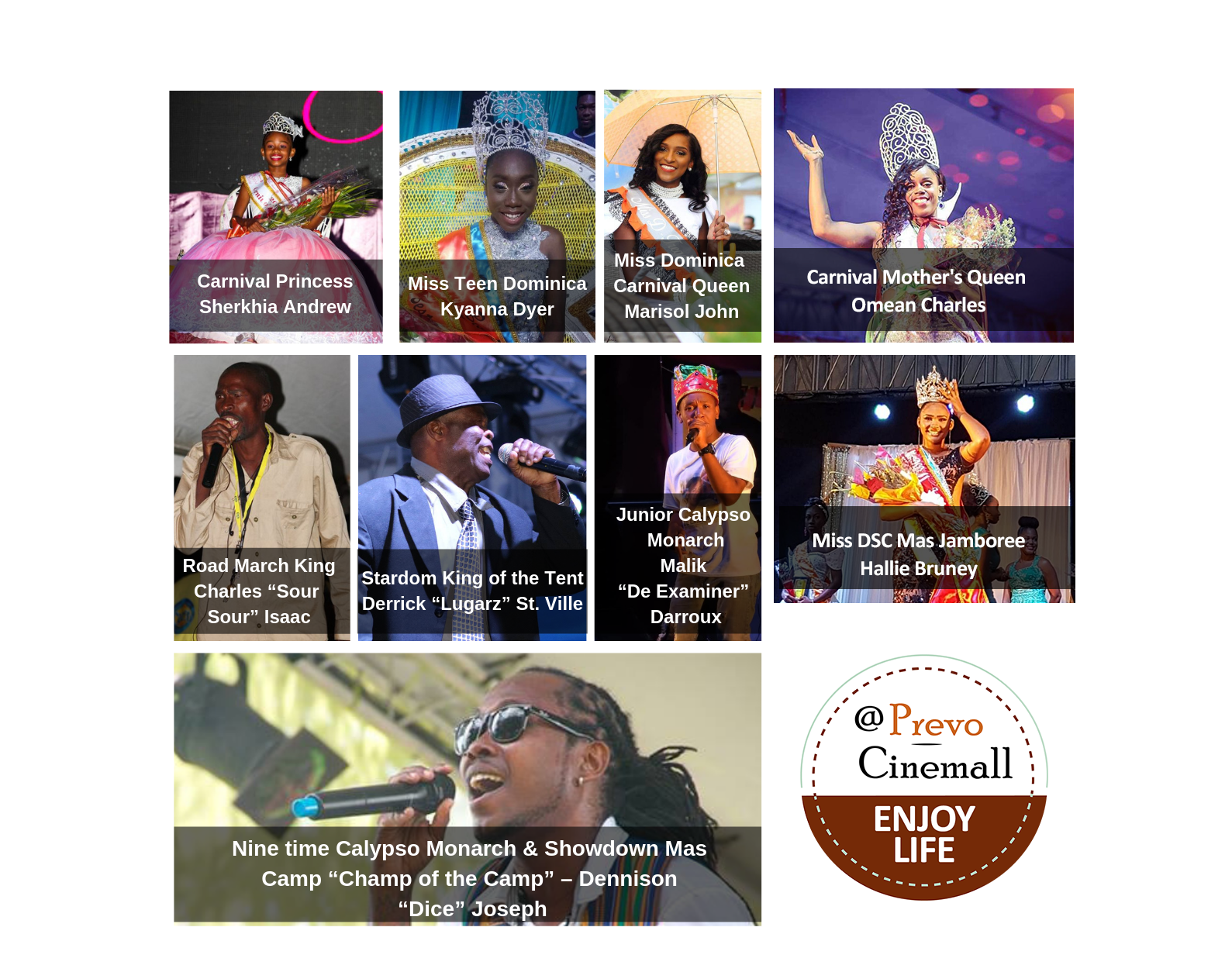

Based on the Commission’s screening, ministers blacklisted today 15 countries. Of those, 5 have taken no commitments since the first blacklist adopted in 2017: American Samoa, Guam, Samoa, Trinidad and Tobago, and US Virgin Islands. 3 others were on the 2017 list but were moved to the grey list following commitments they had taken but have now to be blacklisted again for not having followed up: Barbados, United Arab Emirates and Marshall Islands. A further 7 countries were moved today from the grey list to the blacklist for the same reason: Aruba, Belize, Bermuda, Fiji, Oman, Vanuatu and Dominica. Another 34 countries will continue to be monitored in 2019 (grey list), while 25 countries from the original screening process have now been cleared.