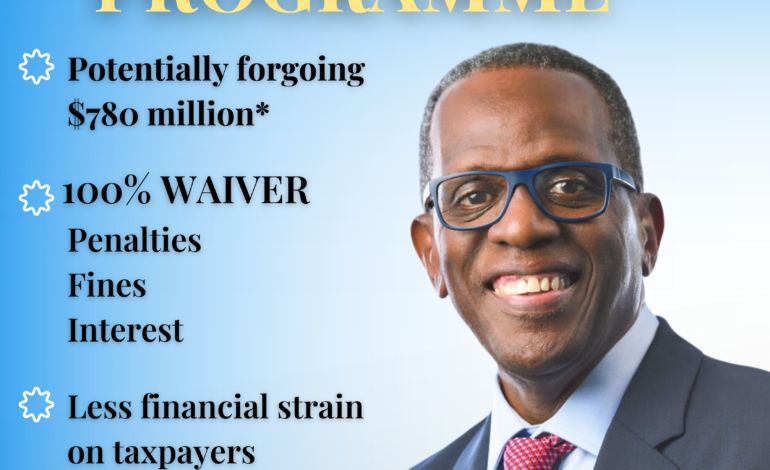

Prime Minister Hon. Philip J. Pierre introduced the tax amnesty programme to ease the burden on taxpayers and allow the uncollected tax revenue to stay in the pockets of everyday citizens and businesses.

In 2022, interest and penalty charges on outstanding taxes owed to the Inland Revenue Department (IRD) amounted to $780 million.

The government is potentially forgoing $780 million in revenue to give everyday citizens and businesses a fighting chance in the face of high inflation and escalating food prices. Cancelling the penalties, fines and interest on outstanding tax payments will alleviate the financial strain on our citizens and local businesses.

Once outstanding taxes are settled in full before May 1, 2024, eligible taxpayers will benefit from a 100% waiver on all applicable charges.