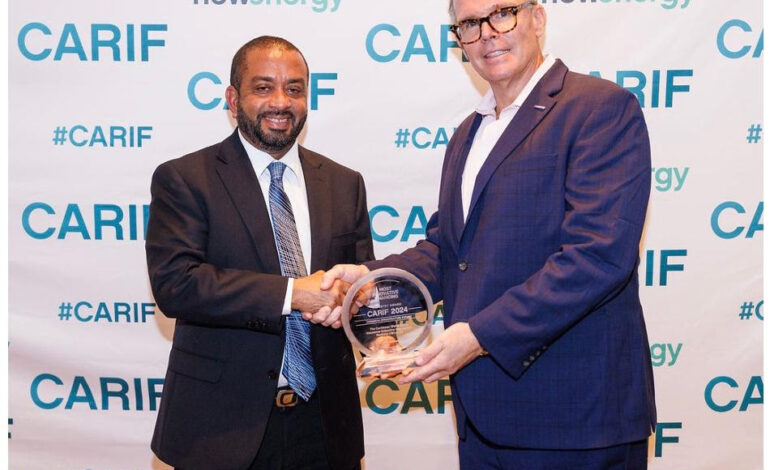

Cayman Islands, October 31, 2024. The Caribbean Water Utility Insurance Collective (CWUIC) recently received an award for the “Most Innovative Financing Programme” at the 2nd Caribbean Infrastructure Forum (CARIF) Industry Awards. CARIF Industry Awards recognize excellence in leadership, innovation, and the advancement of resilient infrastructure across the Caribbean. CWUIC, launched in September 2023, offers water utilities in the Caribbean access to parametric insurance coverage through CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) to financially protect them against extreme weather events such as hurricanes, tropical storms, and excess rainfall events. CWUIC was established as a segregated portfolio (SP)[1] within CCRIF. Other development partners that are providing support to CWUIC are the Inter-American Development Bank (IDB); UK Foreign, Commonwealth and Development Office (FCDO); and the Caribbean Development Bank (CDB). In addition to parametric insurance, CWUIC also provides water utility companies with:Support in emergency response planning and restoring and rebuilding post-disasterAdvisory services and technical assistance to identify and structure priority projects to build water and wastewater utilities’ resilience to natural hazards. CCRIF is the world’s first multi-country, multi-peril risk pool providing parametric insurance and offers parametric insurance products to 30 members – 19 Caribbean governments, 4 Central American governments, 3 Caribbean electric utilities, 3 water utility companies and one Caribbean tourist attraction. CCRIF offers 6 parametric insurance products: for tropical cyclones, excess rainfall, and earthquakes; for the fisheries sector; and for the electric and water utilities sectors. In accepting the award at an event held late last month in Miami, CWUIC Programme Manager, Mr. Christopher Husbands, stated that, “I am deeply honoured to receive this recognition for the Most Innovative Financing Programme on behalf of the Caribbean Water Utilities Insurance Collective (CWUIC). CWUIC was established to assist water utilities mitigate the financial risks posed by natural disasters, ensuring that they can continue to provide essential services even in the face of severe climate events. This award serves as a testament to our commitment to improving the resilience of water infrastructure, protecting communities, and promoting sustainability in a region that is increasingly vulnerable to the impacts of climate change”. Over the years CCRIF has received several global awards for innovation in disaster risk financing. Some of these are highlighted here. In 2008, one year after its inception, the Facility received the Reinsurance Initiative of the Year Award for the reinsurance initiative that generated the most promising change to a significant area of business. The award was presented by The Review, the leading magazine of the international reinsurance industry, founded in 1869. That same year, the Insurance Day London Market Awards presented CCRIF with the ‘Transaction of the Year’ award. In 2013, CCRIF received the Captive Insurance Companies Association’s (CICA’s) Outstanding Captive Award for creative uses for a captive, gaining a positive reputation among rating agencies, regulators, and colleagues in the captive industry. In 2018, CCRIF CEO, Mr. Isaac Anthony, received the Influential Individual of the Year Award at the Reactions 7th Latin America Re/Insurance Awards event based on the work of CCRIF to provide post-disaster relief to the various islands within its membership that were devastated by the impacts of Hurricanes Irma and Maria in 2017.[1] CCRIF’s ability to develop and offer diverse parametric products to non-sovereigns, companies and regions outside the Caribbean such as Central America is based on the fact that, as a segregated portfolio company (SPC), the Facility is able to establish segregated portfolios (SPs) or cells that allow for total segregation of risk and risk management operations (pricing, policy formats etc.) among cells. Under this structure of SPs, CCRIF also is able to provide benefits such as the sharing of operational functions and costs, thereby being able to offer products that cost much less than if each member were to approach the reinsurance market individually. The SP established for CWUIC joins 5 other SPs in the CCRIF structure. |

| In reflecting on the CWUIC award, the CCRIF CEO said, “As the Caribbean and Central America Parametric Insurance Facility and Development Insurer, we continue to push the innovation needle to close the protection gap – which is critical, given the increasing frequency, intensity and unpredictability of climate-related events. Today we are proud to be able to use our parametric insurance base products for tropical cyclones and excess rainfall to create bespoke or unique parametric insurance products for key sectors such as lifeline services (water and electricity) to financially protect these organizations in the face of natural disasters so that they can recover faster and enable their customers to regain access to their services in the shortest possible time”. Grenada’s National Water and Sewerage Authority (NAWASA), along with 2 other Caribbean water utilities (from Dominica and Belize) became members of CCRIF in June 2024 and a month later, Grenada was impacted by Hurricane Beryl. NAWASA received a payout of US$2.2 million or approximately EC$6 million, within 14 days of the passage of Beryl to begin recovery efforts. Following Hurricane Beryl, which affected several CCRIF member countries, CCRIF made 10 payouts totalling US$85,104,700 to 7 of its members as follows:4 governments – Grenada, St. Vincent and the Grenadines, Jamaica, and Trinidad & Tobago2 utility companies – Grenada Electricity Services Ltd. (GRENLEC) and the National Water and Sewerage Authority (NAWASA), Grenada1 tourist attraction, owned by the Government of the Cayman Islands. Since its inception in 2007, CCRIF has made 75 payouts totalling US$359 million. All payouts are made to members within 14 days of the event, in keeping with one of CCRIF’s value propositions. CCRIF payout amounts increase with the level of modelled loss, up to the pre-defined coverage limit set by the policy holder. CCRIF can provide coverage to members of up to US$150 million per policy. The absence of insurance has negative consequences for the scale and duration of the economic impacts of disasters and catastrophe risk insurance provided by CCRIF can effectively provide a level of financial protection for countries vulnerable to natural hazards. CCRIF was not set up to cover all the losses on the ground but was designed to provide a rapid infusion of liquidity, which members can use to address immediate priorities and to support the most vulnerable. Assessments made by CCRIF on the use of payouts reveal that over 5 million persons in the Caribbean and Central America have benefitted from these payouts. Over the years, CCRIF payouts have been used to provide food, shelter and medicine for affected persons; stabilize drinking water plants; provide building materials for persons to repair their homes; repair critical infrastructure such as roads, bridges and schools; and support the agriculture sector among many other uses. In the last five years, members have routinely ceded over US$1 billion in insurance coverage to CCRIF. For the 2024/25 policy year, total coverage purchased by CCRIF members increased by 10 per cent compared with the 2023/24 policy year. |

| About CCRIF SPC:CCRIF SPC is a segregated portfolio company, owned, operated, and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes, and excess rainfall events to Caribbean and Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest possible pricing. CCRIF offers parametric insurance policies to Caribbean and Central American governments for tropical cyclones, earthquakes, excess rainfall and fisheries and also to electric and water utility companies in the Caribbean. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, the Central America and Caribbean Catastrophe Risk Insurance Program (CACCRIP) MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development (BMZ) and KfW. Additional financing has been provided by the Caribbean Development Bank (CDB), with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and the World Bank. In 2024, CCRIF received funding from CDB, through the Canada-CARICOM Climate Adaptation Fund, to enable seven CCRIF members to increase their coverage and make their national social protection systems more shock responsive. |