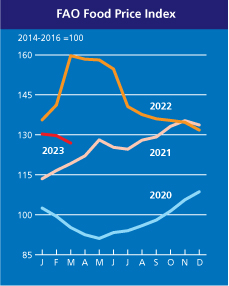

Rome –The benchmark index of international food commodity prices declined for the 12th consecutive month in March, driven by declines in world quotations for cereals and vegetable oils, the Food and Agriculture Organization of the United Nations (FAO) reported today.

The FAO Food Price Index, which tracks monthly changes in the international prices of commonly-traded food commodities, averaged 126.9 points in March 2023, down 2.1 percent from the previous month and 20.5 percent below its peak level of March 2022. A mix of ample supplies, subdued import demand and the extension of the Black Sea Grain Initiative contributed to the drop.

The FAO Cereal Price Index declined 5.6 percent from February, with international wheat prices falling by 7.1 percent, pushed down by strong output in Australia, improved crop conditions in the European Union, high supplies from the Russian Federation and ongoing exports from Ukraine from its Black Sea ports. World maize prices fell by 4.6 percent, due partly to expectations of a record harvest in Brazil, while those of rice eased by 3.2 percent amid ongoing or imminent harvests in major exporting countries, including India, Viet Nam and Thailand.

The FAO Vegetable Oil Price Index averaged 3.0 percent lower than the previous month and 47.7 percent below its March 2022 level, as ample world supplies and subdued global import demand pushed down soy, rapeseed and sunflower oil quotations. That more than offset higher palm oil prices, which rose due to lower output levels in Southeast Asia due to floodings and temporary export restrictions imposed by Indonesia.

“While prices dropped at the global level, they are still very high and continue to increase in domestic markets, posing additional challenges to food security. This is particularly so in net food importing developing countries, with the situation aggravated by the depreciation of their currencies against the USA dollar or the Euro and mounting debt burden,” stressed Máximo Torero, FAO Chief Economist.

The FAO Dairy Price Index declined 0.8 percent in March. Butter prices increased due to solid import demand, while those of cheese dipped due to slower purchases by most leading importers in Asia as well as increased availabilities in leading exporters.

By contrast, the FAO Sugar Price Index rose by 1.5 percent from February to its highest level since October 2016, reflecting concerns over declining production prospects in India, Thailand and China. The positive outlook for the sugarcane crops about to be harvested in Brazil limited the upward pressure on prices, as did the decline in international crude oil prices, which reduced demand for ethanol.

The FAO Meat Price Index rose slightly, by 0.5 percent. International bovine meat quotations rose, influenced by rising internal prices in the United States of America on expectations of lower supplies moving forward, while pig meat prices rose due to increased demand in Europe ahead of holidays. Despite avian influenza outbreaks in several large exporting countries, world poultry meat prices fell for the ninth consecutive month on subdued global import demand.

More details are available here.

Update on prospects for crop production, utilization, trade and stocks

In the Cereal Supply and Demand Brief, also released today, FAO raised its forecast for world wheat production in 2023, now pegged at 786 million tonnes, which would be 1.3 percent below the 2022 level and the second largest outturn on record. Near-record sown areas are expected in Asia, while dry conditions are impacting North Africa and southern Europe.

In the southern hemisphere, the sown area and production prospects for maize in Brazil are expected at an all-time high, underpinned by robust export demand. Yield prospects are also good in South Africa, which may record its second-largest harvest in 2023. By contrast, prolonged dry conditions have adversely affected maize crops in Argentina.

FAO has also raised its forecast for world cereal production in 2022 to 2 777 million tonnes, now down only 1.2 percent from the previous year. World rice production in 2022/23 is now pegged at 516 million tonnes, 1.6 percent below the record reached in 2021/22 but an above-average harvest.

FAO’s updated forecast for world cereal utilization in 2022/23 now stands at 2 779 million tonnes, down 0.7 percent from 2021/22. World cereal stocks by the close of the 2022/2023 seasons are expected to decline by 0.3 percent from their opening levels to 850 million tonnes. The world cereal stocks-to-use ratio will likely dip from 30.7 percent in 2021/22 to 29.7 percent, still, nevertheless, indicating an overall comfortable global level.

World trade in cereals in 2022/23 is predicted to contract by 2.7 percent from the 2021/22 level to 469 million tonnes. The decline mostly reflects expectations of reduced trade of coarse grains, while global wheat trade is anticipated to increase. International trade in rice in 2023 is forecast to decline by 5.2 percent below the 2022 record high level.

More details are available here.